Best Practice Solution Set

for Distributors

for Distributors

Salesforce Makes Sales & Collections a Partnership

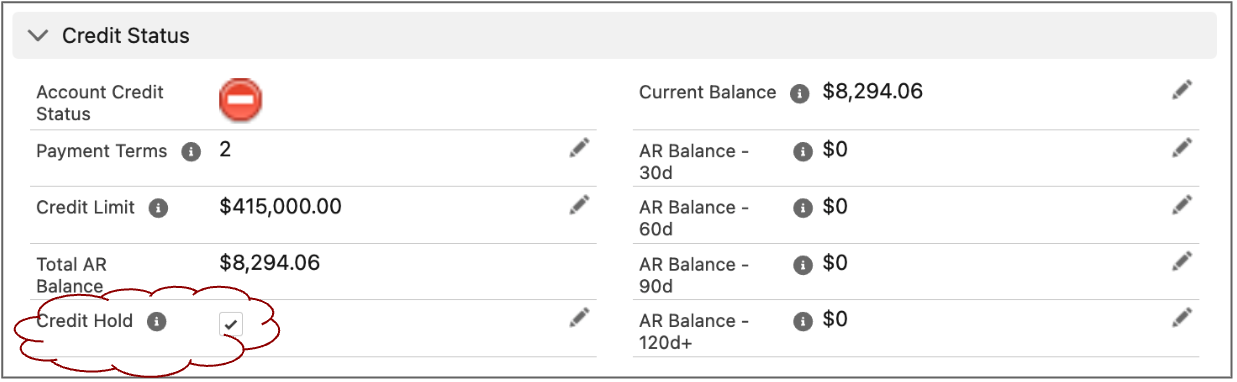

In the world of distribution, with a highly-fragmented customer base, keeping receivables current is a constant load for Finance. But when one of your top customers stretches you, and Collections clamps down with a credit hold, you generally have TWO unhappy parties – the customer and Sales, who just got surprised when a major source of commissions suddenly can’t buy anything.

So. What if this could be shifted in everyone’s favor? How about we proactively surface emerging overdue customer accounts for each sales rep who owns them? No surprises! And we leverage motivated sales reps to help get that AR balance down before Collections has to send the nastygram?

Put AR Data into Sales’ Reps Hands

Let’s be honest here: Sales is king, but when they are given jester-level visibility, how can we expect them to rule their client kingdom? All that to say, sales reps—and your bottom line—could greatly benefit from lifting the veil by integrating your ERP data into Salesforce to surface crucial financial information in a clear, easily digestible view. Now, your sales team can call up those stretched accounts before they get the dreaded automated “Your bill is 30 days overdue; pay or else” email.

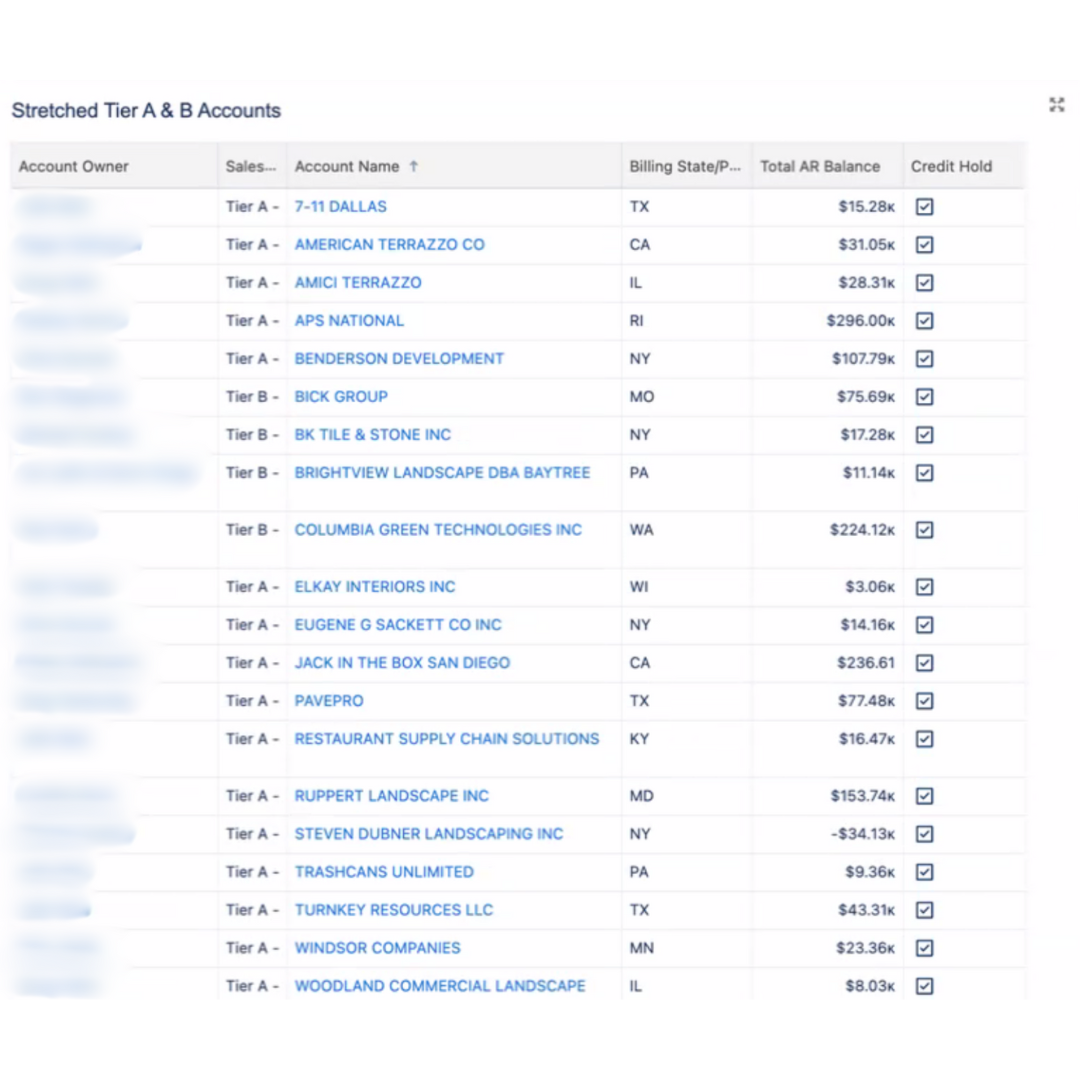

Keep Customers Out Of Collections

How about a dashboard for each sales rep, displaying all top-tier customers who are on the verge of credit trouble? That empowers Sales to proactively reach out before they get to the counter in the branch and find out their account is on hold. Your sales reps know their clients better than collections and can easily call up their contacts and resolve things before any issues arise.

Do you know who else likes this solution? The finance department. Sales and Finance can now work in unison, making more money for the business and keeping everyone on the same page. That’s just one of many solutions Salesforce brings to distribution customers.